Dreaming of owning a home in sunny San Diego? Starting the leap towards homeownership has never been easier! An FHA loan can be your ticket to realizing your dream. With its flexible requirements and competitive interest rates, an FHA loan makes homeownership available for a wider range of buyers. Just wait any longer to begin your journey!

Get pre-approved today and uncover how much home you can afford in the vibrant San Diego market. Our skilled loan officers are here to support you through the entire process, guaranteeing a seamless experience.

- Benefits of Getting Pre-Approved for an FHA Loan in San Diego

- Increased buying power

- Faster closing times

- Competitive interest rates

Comprehending FHA Loan Rates in San Diego, CA

Navigating the fluctuating housing market in San Diego, CA can be a complex endeavor. For aspiring homebuyers, comprehending FHA loan rates is crucial for making informed decisions. FHA loans, insured by the Federal Housing Administration, are frequently used options for those with moderate credit fha loan san diego benefits scores or down payment amounts.

In San Diego's robust real estate landscape, FHA loan rates can vary substantially. Several factors influence these rates, such as the current interest rate environment, your loan-to-value ratio, and the specific lender you choose.

- Comparing multiple lenders is strongly advised

- Monitoring current market trends can help you in finding the most favorable rates available.

Purchasing Your Dream Home in San Diego with FHA Loans

San Diego's booming real estate market offers a wealth of opportunities for potential homeowners. If you're exploring an FHA loan to make your homeownership dreams a possibility, you'll want to partner with a trusted lender. With various FHA lenders in San Diego, finding the ideal match can seem challenging.

To simplify your search, we've assembled a list of some of the highest-ranked FHA lenders in San Diego. These lenders concentrate in FHA loans and possess a deep expertise of the program's guidelines.

- Think about your individual needs

- Investigate different lenders and their terms

- Evaluate various loan options to find the best fit for you

Unlocking Homeownership with FHA Loans in San Diego

Ready to become a homeowner across the vibrant city of San Diego? FHA-backed mortgages offer a fantastic opportunity for aspiring homebuyers to achieve their dreams. These government-insured financing programs are known for their accessible guidelines, making them a popular choice for buyers with diverse financial situations.

Within San Diego's competitive real estate market, FHA loans can provide the edge you need to secure your desired dwelling. With lower down payment options, FHA loans empower you to enter your new living space with greater ease.

Explore the benefits of FHA loans and uncover how they can unlock homeownership in beautiful San Diego.

Benefits of Choosing an FHA Loan in San Diego

Looking to buy a home in sunny San Diego? An FHA loan could be the perfect option for you. These government-backed loans are designed to help homeownership more accessible by requiring lower down payments and favorable credit score requirements. With an FHA loan, you can likely gain access the San Diego real estate market even with a smaller financial profile.

- Lower down payment options can make homeownership more attainable

- More flexible credit score requirements

- Potential for lower interest rates compared to conventional loans

- San Diego's vibrant real estate market offers a wide range of properties to choose from

Could An FHA Loan Be a Good Fit for You in the San Diego Housing Market?

San Diego's thriving housing market can be stressful to navigate, especially for first-time homebuyers. An FHA loan might be a beneficial tool if you're looking to purchase your dream home in this popular location.

These loans are insured by the Federal Housing Administration (FHA), which means lenders can offer flexible conditions.

One of the biggest benefits of an FHA loan is the lower down payment requirement, typically as low as 3.5%. This can make homeownership easier to achieve for those who might not have adequate funds for a traditional down payment.

Another benefit of FHA loans is that they are more forgiving when it comes to credit scores. Borrowers with lower credit scores may still be eligible for an FHA loan, which can be a game-changer in a tight market like San Diego's.

However, it's important to weigh all elements before deciding if an FHA loan is right for you.

Mortgage insurance premiums (MIP) are required with FHA loans and can add to your monthly costs. Additionally, there may be other fees associated with FHA loans.

If you're seriously considering buying a home in San Diego, speak to a qualified mortgage lender to examine your options and determine if an FHA loan is the best fit for your specific situation.

Edward Furlong Then & Now!

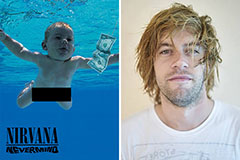

Edward Furlong Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!